Want to trade in a car you’re still paying off? This 2025 guide shows you how to do it the smart way — without getting burned.

Quick Summary

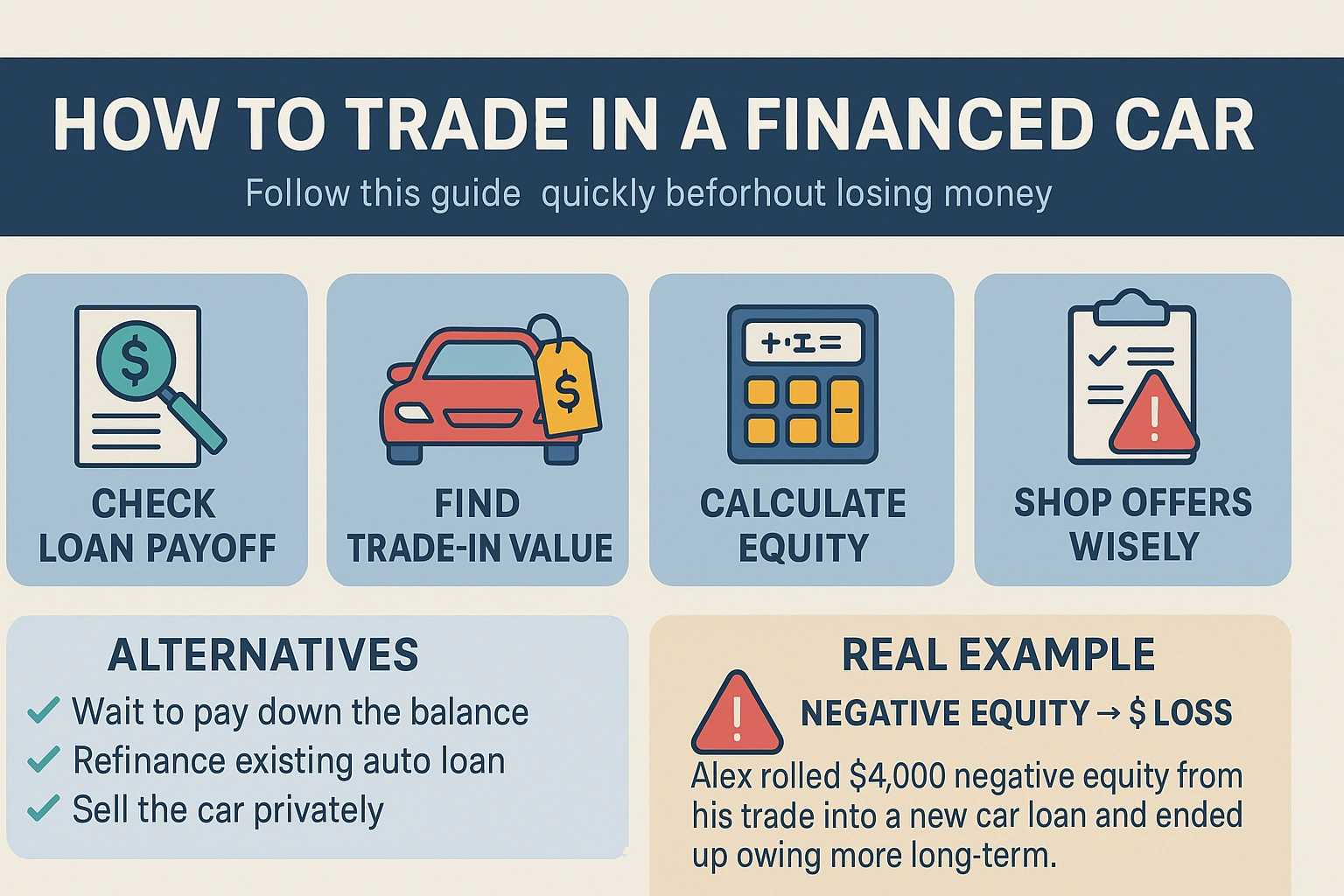

You can trade in a financed car — but only if you understand your equity, payoff amount, and how dealers structure deals. Use this step-by-step guide to avoid costly mistakes [[10]].

Step 1: Get Your Loan Payoff Amount

Contact your lender and request a **10-day payoff quote** — this includes the full amount needed to close your loan, including interest and fees [[3]].

Why it matters: This tells you whether you have positive or negative equity.

Step 2: Find Out Your Car’s Trade-In Value

Use trusted tools like:

Compare trade-in value vs private sale value to understand what dealers are likely to offer.

Step 3: Calculate Your Equity Position

- Positive equity: Car value > Loan payoff → You can apply the difference toward a new car.

- Negative equity: Loan payoff > Car value → You’ll need to roll over the difference or pay it upfront.

Tip: Avoid rolling negative equity into a long-term loan — it creates a financial snowball effect [[4]].

Step 4: Shop Around for Offers

Don’t take the first dealership offer. Visit multiple dealerships — especially those with aggressive trade-in bonuses or special financing offers.

You can also get no-haggle online offers from:

Step 5: Watch Out for Common Pitfalls

- 💸 Overpaying on interest due to poor rollover terms

- 🔍 Dealers hiding negative equity in inflated new car prices

- 📉 Accepting low-ball trade offers without checking market value

🚗 Trading In a Financed Car? Don’t Settle for a Bad Deal

Find out what your car is really worth before heading to the dealer. Compare offers online and make sure you’re getting top dollar—no surprises in 2025.

Alternatives to Trading In

If you’re deeply upside-down on your current loan, consider:

- Waiting 6–12 months and paying down your balance

- Refinancing your existing loan

- Selling the car privately (you’ll need to pay off the loan first)

Real Example: When Rolling Over Equity Backfires

Alex rolled $4,000 of negative equity into a new 72-month SUV loan — and ended up owing more than the car was worth for over three years. Always calculate before trading [[4]].

Frequently Asked Questions

Can I trade in my car if I still owe money on it?

Yes. Most dealerships will pay off your loan and apply any equity (positive or negative) toward the new vehicle financing [[1]].

Is it better to sell my car privately instead of trading it in?

In many cases, yes. Private sales usually bring higher prices — but require you to fully pay off the loan before transferring ownership [[7]].

What does “rollover negative equity” mean?

This means carrying over the remaining debt from your old car into your new loan. It can put you underwater again — so proceed carefully [[4]].

How do I know what my car is really worth?

Use KBB, Edmunds, or CarMax to get accurate estimates based on your car’s condition, mileage, and location [[5]].

Can I trade in my financed car online?

Yes! Platforms like CarMax, Shift, and Vroom let you get appraisals and even complete part of the transaction remotely [[2]].