Allstate Reviews Car Insurance: Real Ratings, Pricing & Claims Insights

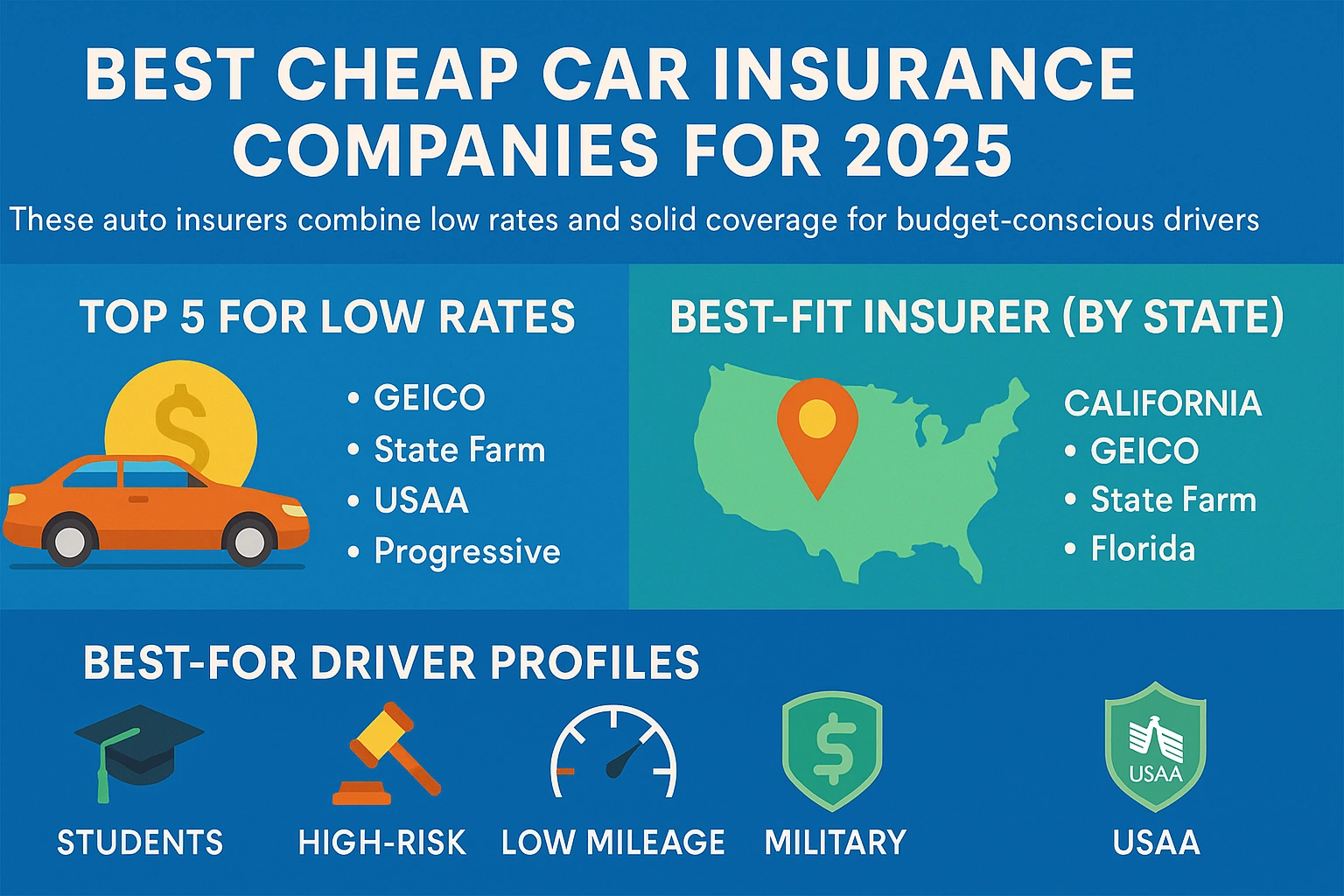

Looking for Allstate reviews car insurance before committing to a new policy? You’re not alone. With rising premiums across the U.S., drivers want solid facts, real feedback, and honest comparisons before choosing a provider. This guide gives you exactly that—expert analysis, pricing breakdowns, pros and cons, and how Allstate stacks up against GEICO and State Farm.

Quick Summary: Is Allstate Worth It in 2025?

- Founded: 1931

- Coverage: Nationwide (50 states)

- AM Best Rating: A+ (Superior)

- Average Premium: ~$3,350 annually

- Top Feature: Drivewise telematics discount program

Allstate is ideal for drivers who want a balance of digital convenience and in-person agent support—but it may not be the most budget-friendly option.

What You Should Know About Allstate

Company Background

Allstate was founded in 1931 and is now one of the largest personal lines insurers in the U.S. It has more than 16 million customers and over 10,000 agents. Its financial strength rating of A+ from AM Best signals long-term reliability.

Customer Sentiment & Ratings

Feedback on Allstate is mixed. While some praise the brand for ease of use and bundling options, others report high premiums and inconsistent claims service.

| Review Source | Rating | Key Takeaway |

|---|---|---|

| NerdWallet | 4.5 / 5 | Good for safe drivers using Drivewise |

| WalletHub | 2.8 / 5 | Mixed reviews on claims and service |

| TrustPilot | 2.0 / 5 | Concerns about delays in payments |

Expert Tip: Always compare reviews from multiple platforms—not just one site—to get a complete picture.

Pros and Cons of Allstate Auto Insurance

Advantages

- Strong brand recognition and financial stability

- Available local agents across the U.S.

- Excellent mobile app experience

- Telematics program with real discounts

Drawbacks

- Higher-than-average premiums for many profiles

- Mixed customer service reviews

- Telematics program may track more than you expect

Unique Value: Allstate’s blend of human and digital service sets it apart—ideal for drivers who want personal advice but also app-based functionality.

How Much Does Allstate Car Insurance Cost?

Average Annual Rates

| Driver Profile | Allstate Avg. Premium |

|---|---|

| Good Driver (Age 35) | $3,350 |

| Young Driver (Age 20) | $5,700+ |

| Driver with DUI | $6,800+ |

Available Discounts

- Drivewise (safe driving)

- Multi-policy (home + auto)

- Early signing and renewal

- New car, anti-theft, and safety devices

Expert Tip: Combining Drivewise and bundling can cut costs by 15–25%—but check availability in your state.

Drivewise & Mobile App: High-Tech Features

Drivewise Explained

Allstate’s Drivewise monitors braking, acceleration, and speed. Drivers can earn rewards for safe habits, but should be aware that GPS tracking is active by default.

Mobile App Performance

- Apple App Store: 4.8 / 5

- Google Play Store: 4.5 / 5

- Features: digital ID cards, claims filing, Drivewise dashboard

Important: You can disable location tracking for Drivewise outside of trips via app settings.

Allstate’s Claims Process: What to Expect

Filing and Follow-Up

- File online, via the app, or call an agent

- Upload supporting documents and photos

- Get assigned a claims adjuster

- Track progress through the mobile app

Customer Experiences

- Fast for basic fender benders

- Slower on injury-related claims

- Mixed communication reviews

Expert Tip: Save all communications and request a written status update every 3–5 days if delays occur.

Allstate vs. GEICO vs. State Farm: Side-by-Side

| Feature | Allstate | GEICO | State Farm |

|---|---|---|---|

| Avg. Annual Premium | $3,350 | $2,250 | $2,400 |

| Mobile App Rating | 4.8 | 4.6 | 4.7 |

| Agent Availability | ✔️ | ❌ | ✔️ |

| Telematics | Drivewise | DriveEasy | Drive Safe & Save |

If affordability is key, GEICO wins. But for service and personalization, Allstate and State Farm lead the pack.

Who Should Choose Allstate?

- Drivers aged 30–55 with clean records

- Families looking to bundle policies

- Those who want local agents and a quality app

Young drivers or those with prior violations may find cheaper options elsewhere.

Maximizing Value with Allstate

Want to make the most of your Allstate policy? Follow these steps:

- Compare quotes from multiple insurers

- Enable all applicable discounts

- Bundle policies where possible

- Check your driving profile every 6 months

Next Step: Compare rates in your area now and see if Allstate fits your budget and lifestyle.

Conclusion: Is Allstate Right for You?

Allstate offers a trusted name, great technology, and agent-backed service—but it comes at a premium. If that aligns with your values, it could be a smart investment. If you’re price-sensitive, it’s worth comparing options.

Ready to explore? Use our insurance comparison tool to see how Allstate stacks up for you.